Money is a funny thing. We work for and use it daily. It pays taxes, puts a roof over our heads, food on our table, and clothes on our back. It’s a part of our life every single day as adults and yet it’s something many of us still struggle to talk to our kids about. Trust me, I know because I was one of them, until I realized I was failing them.

I noticed that my girls weren’t “getting” me when I said I didn’t have enough money in my budget for a certain item. They felt I should just be able to charge it, or whip out my debit card and miraculously the money I needed would be there. They didn’t “get” that we paid for things like electricity, gas and internet usage. After all, I didn’t walk into a store and pay for these things like groceries. These payments are made automatically out of my bank account, so to my kids it would seem that these things cost us nothing.

Three Ways I Started Talking About Money to My Kids

Be Open

The first thing I did was to remove the shroud of secrecy around money in our house. If my kids ask what I earn, or how much something costs, I tell them. Obviously there’s a discussion involved about privacy, but ultimately I want them to know how money works. We don’t have a lot of years with them at home before they are out on their own and I want them to be financially literate when they do leave.

Open Bank Accounts

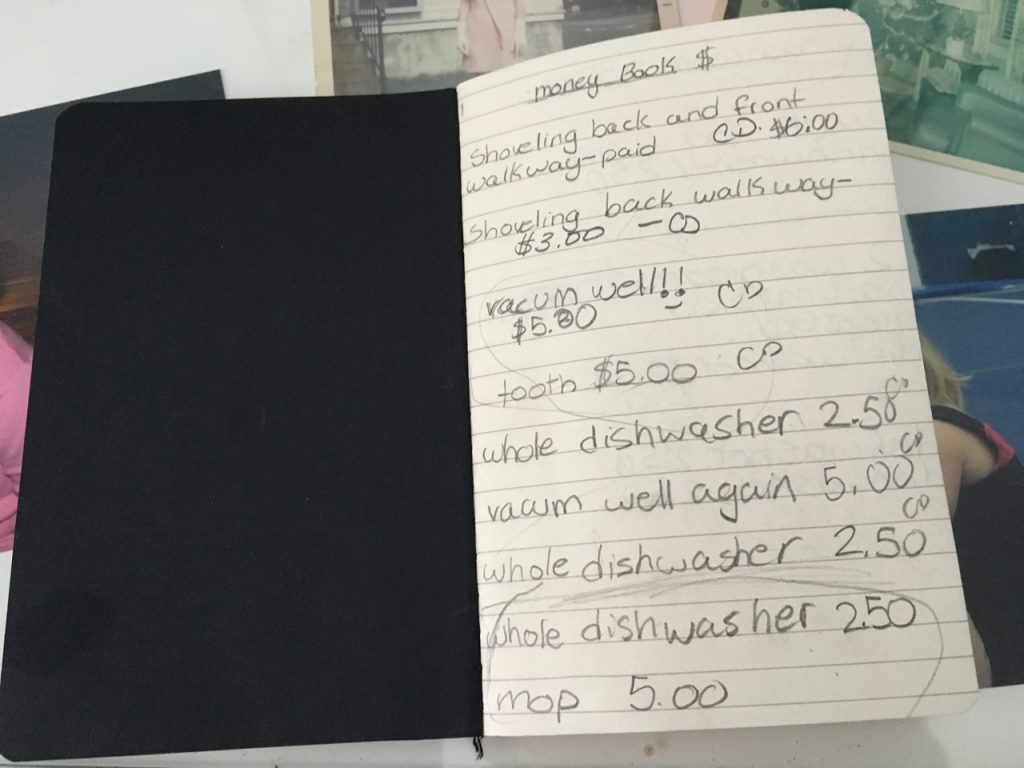

Second, we visited our local BMO Bank of Montreal and each of them opened a chequing and savings account. When my kids earn money now, they submit an invoice to me weekly. It is their job to keep track of what was done, how much was earned and the total I owe them. I then sign off on the work and send them an E-Transfer for the money owed to their email accounts. They then deposit the money to their chequing account online and immediately transfer a portion to their savings account. It is their responsibility to carry their debit cards with them when we go out shopping.

Make Them Accountable

Third, I pay them well for their chores, so I’ve downloaded some very real expenses to them. Clothing, make-up, books, magazines, ice cream cones, souvenirs, etc. If they want something they a) need to work for it and b) need to budget for it. This requires discipline on my part to not bail them out when they fail to plan accordingly, but I remind myself that it is better to learn these lessons in the comfort of their parent’s home, instead of in their twenties with creditors knocking.

As they continue to mature, the lessons will change and thankfully our bank, BMO, is there to offer us support at every step. I check in frequently to their Kids and Money site for new ways to teach my kids the importance of financial literacy.

BMO is working hard to make Financial Literacy a focus for all Canadians. They know that money is deeply personal and that relationships with money, good and bad, are forged at a young age. That’s why they launched the Talk with Our Kids About Money program with the Canadian Foundation for Economic Education. This site is loaded with tools and resources for parents and educators to help build money conversations into their day-to-day interactions with their kids. This program is absolutely free to everyone, but offers invaluable information for kids ages 5 to 18.

If you’re worried that you might have missed the boat with your kids, remember that it’s never too late to start the conversation. A great way to jump in is on BMO’s Talk With Our Kids About Money Day on April 20, 2016. Follow BMO on Twitter and Facebook for great conversations starters and start talking, #TWOKAM.

This post was sponsored by BMO but the images and opinions are my own.

Why You and Your Car Both Need a Spring Tune-Up

Why You and Your Car Both Need a Spring Tune-Up